property tax on leased car connecticut

Sales Tax Rate Over 50000. If you do not register a motor vehicle but retain ownership you must annually file a declaration form.

Nj Car Sales Tax Everything You Need To Know

Later than the thirty-first day of December next following the date the property tax is due.

. Failure to file by the deadline constitutes waiver of the right to claim the property tax exemption or refund for which CGS 12-8153 provides. Local motor vehicle taxes and fees generally pay them unless the lease agreement requires otherwise. Connecticut collects a 6 state sales tax rate on the purchase of all vehicles.

Mississippi and Rhode Island have the second and third. When you lease a vehicle the car dealer maintains ownership. Property Tax On Leased Car ConnecticutIf you do pay the personal property tax you can deduct it on your taxes if.

For Connecticut Resident on Active Military Duty. If the lease agreement states that you are responsible for these taxes you will receive an invoice from the dealer. Tax assessors bill the car dealer for vehicle taxes but whether or not they pass that on to you will be delineated in your lease contract.

If you do pay the personal property tax you can deduct it. A mill rate is equal to 1 in taxes for every 1000 in assessed value. They are not subject to local taxes.

Generally property tax bills due and paid during 2017 qualify for this credit. To calculate your tax based on your mill rate divide your assessed value. If you do not register a motor vehicle but retain ownership you must annually file a personal property declaration form with your assessor between October 1 and November 1.

This applies whether or not the vehicle is registered. 2021 Property Tax Credit Calculator. Initial Car Price 1.

It is an annual assessment on personal property by the state and since BMWFS would own the car they would get the bill. Sales From Licensed Dealers - If the vehicle was purchased from a licensed dealer the 635 or 775 for vehicles over 50000 sales and use tax is based on the purchase price. In addition to taxes car purchases in Connecticut may be subject to other fees like registration title and plate fees.

Motor Vehicles are subject to a local property tax under Connecticut state law. Sales Tax Rate Under 50000. The local property tax is computed and issued by your local tax collector.

To be clear this is different than the sales tax on the sale of the car. You may take credit against your 2017 Connecticut income tax liability for qualifying property tax payments you made on your primary residence privately owned or leased motor vehicle or both to a Connecticut political subdivision. The terms of the lease decide which party is responsible for the personal property tax.

No tiene Productos en su Cesta de la Compra. For vehicles that are being rented or leased see see taxation of leases and rentals. There residents pay an effective rate of 405 meaning an annual bill of 1011.

I know this is considered a tax deduction. According to Connecticuts Department of Motor Vehicles DMV you must pay a 635 percent sales tax or 775 percent sales tax on vehicles over 50000 upon the purchase of your vehicle from a. Fast forward 2 years and now Chase is sending me a property tax bill for the whole year of 2019 for the car.

Yes you may take a credit against your 2016 Connecticut income tax liability for qualifying property tax payments you made to your Connecticut town or taxing district on your privately owned or leased motor vehicle or both. Motor vehicles are subject to a local property tax under Connecticut state law whether registered or not. Paid qualifying property tax on your PRIMARY RESIDENCE ANDOR MOTOR VEHICLE during 2021 AND.

Initial Car Price 2. 170 rows Town Property Tax Information. Quick question to any CT Lease holders or dealers.

A dealer who rents a vehicle retains ownership. In most cases the agreement made between the dealer or leasing agency and the person leasing the vehicle will pass the cost of property taxes on to the lessee most. Excise taxes in Maine Massachusetts and Rhode Island.

One or both of the following statements apply. Municipalities in Connecticut apply property taxes in terms of mill rates. Sales Tax for Car 1 30000 - 5000 0635 Sales Tax for Car 1 158750.

The property tax liability for a motor vehicle that is leased rather than sold outright to someone remains with the business that holds title to the vehicle ie the leasing agency or dealer. Full trade-in credit is allowed when computing the Connecticut Sales and Use tax if the vehicle was purchased from a licensed dealer. 2021 PROPERTY TAX CREDIT CALCULATOR.

And motor vehicle registration fees in New Hampshire. Calculate Car Sales Tax in Connecticut Example. I called Chase and they are saying that the 20 dollar increase in monthly payment that I was paying was in fact for CT sales tax.

Virginia has the highest vehicle taxes the report found. If your filing status for connecticut income tax purposes is single filing separately for connecticut only or head of household you may include qualifying property tax payments on only one motor vehicle you own or lease even if you sell a motor vehicle and. Leased and privately owned cars are subject to property taxes in Connecticut.

Motor Vehicle Property Tax Exemption or Benefit Application. The maximum credit allowed on your motor vehicle is 200 per return regardless of filing status. Connecticut Property Tax Rates.

You are a Connecticut resident AND. Sales Tax for Car 2 65000 - 5000 0775. Does BMWFS bill back the cost of the annual personal property tax in Connecticut to the lease holder.

The Assessor may require you to submit motor vehicle lease verification. CITY OF STAMFORD Assessors Office 888 Washington Blvd Stamford CT 06901 Tel. You may use this calculator to compute your Property Tax Credit if.

Under Connecticut state law CGS 12-8153 one passenger motor vehicle belonging to or held in trust for any member of the United States. You can find these fees further down on the page. I leased the car in NY and when I did that NY sales tax was already calculated into my monthly payment.

In all cases the tax advisor charges the taxes to the dealer and the dealer pays.

General Information Assessment And Collection

Connecticut Leasees Property Taxes Off Ramp Forum Leasehackr

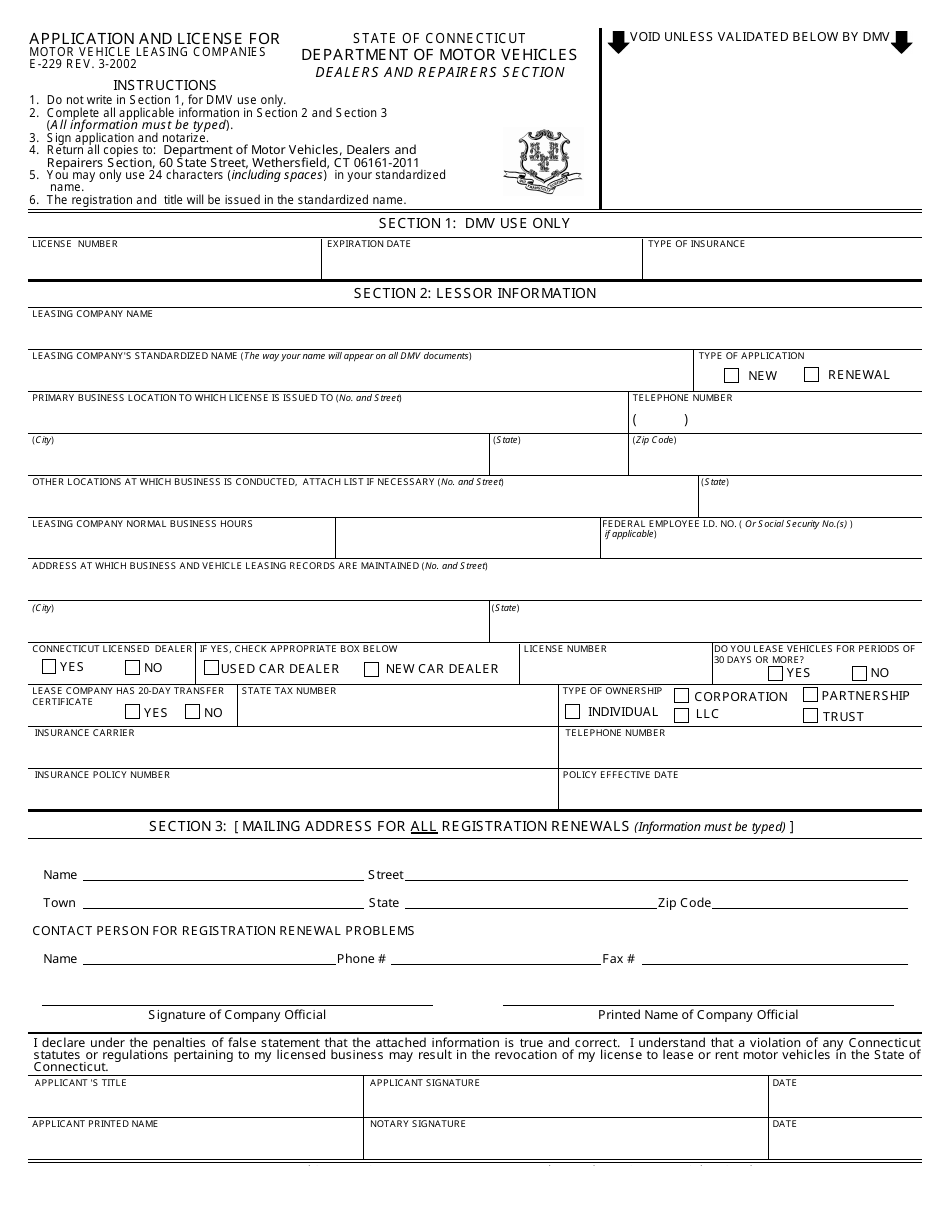

Form E 229 Download Fillable Pdf Or Fill Online Application And License For Motor Vehicle Leasing Companies Connecticut Templateroller

Connecticut S Sales Tax On Cars

Bill To Remove Taxes On Vehicles Leased To Government Still Alive Preston County News Wvnews Com

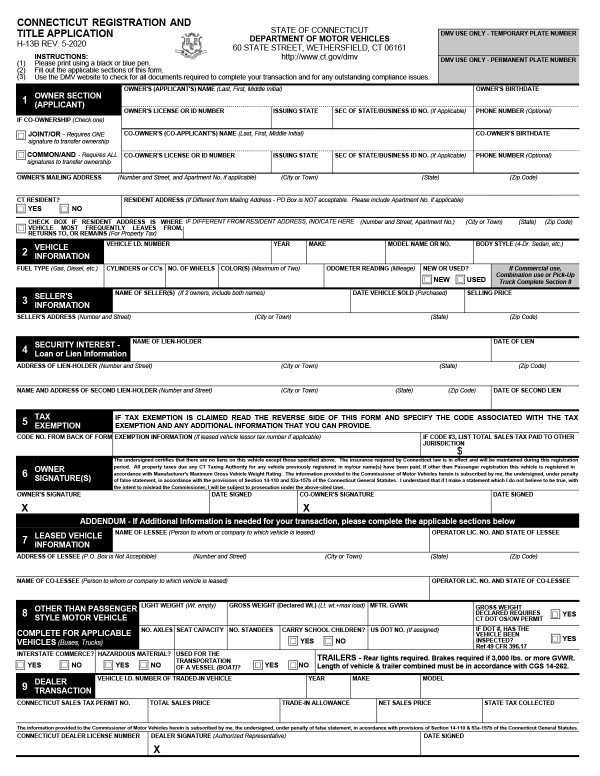

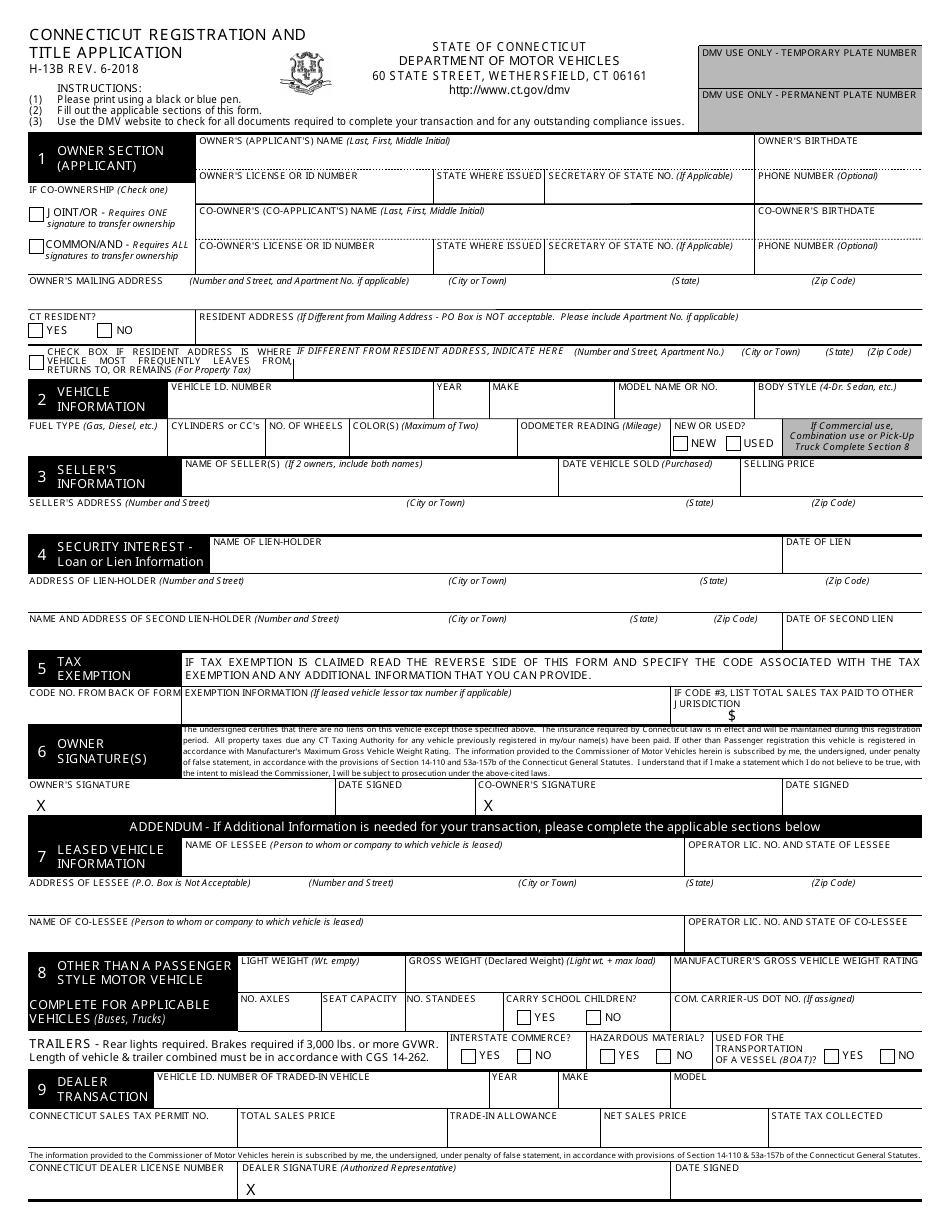

Connecticut Bill Of Sale Templates And Registration Requirements

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars

2022 Bentley Flying Spur Lease Monthly Leasing Deals Specials Ny Nj Pa Ct

Who Pays The Personal Property Tax On A Leased Car

Best Luxury Car Incentives Leases And Loans For December Forbes Wheels

2022 Hyundai Santa Fe Monthly Lease Deals Specials Ny Nj Pa Ct

Who Pays The Personal Property Tax On A Leased Car

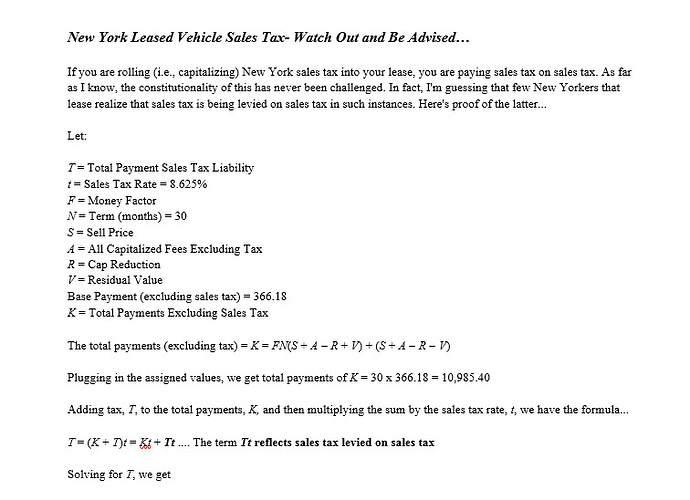

Sales Tax In Ny Off Ramp Forum Leasehackr

Learn How To Get Money For Your Car Lease Atax Center Llc

Which U S States Charge Property Taxes For Cars Mansion Global

Form H 13b Download Fillable Pdf Or Fill Online Connecticut Registration And Title Application Connecticut Templateroller